san francisco payroll tax withholding

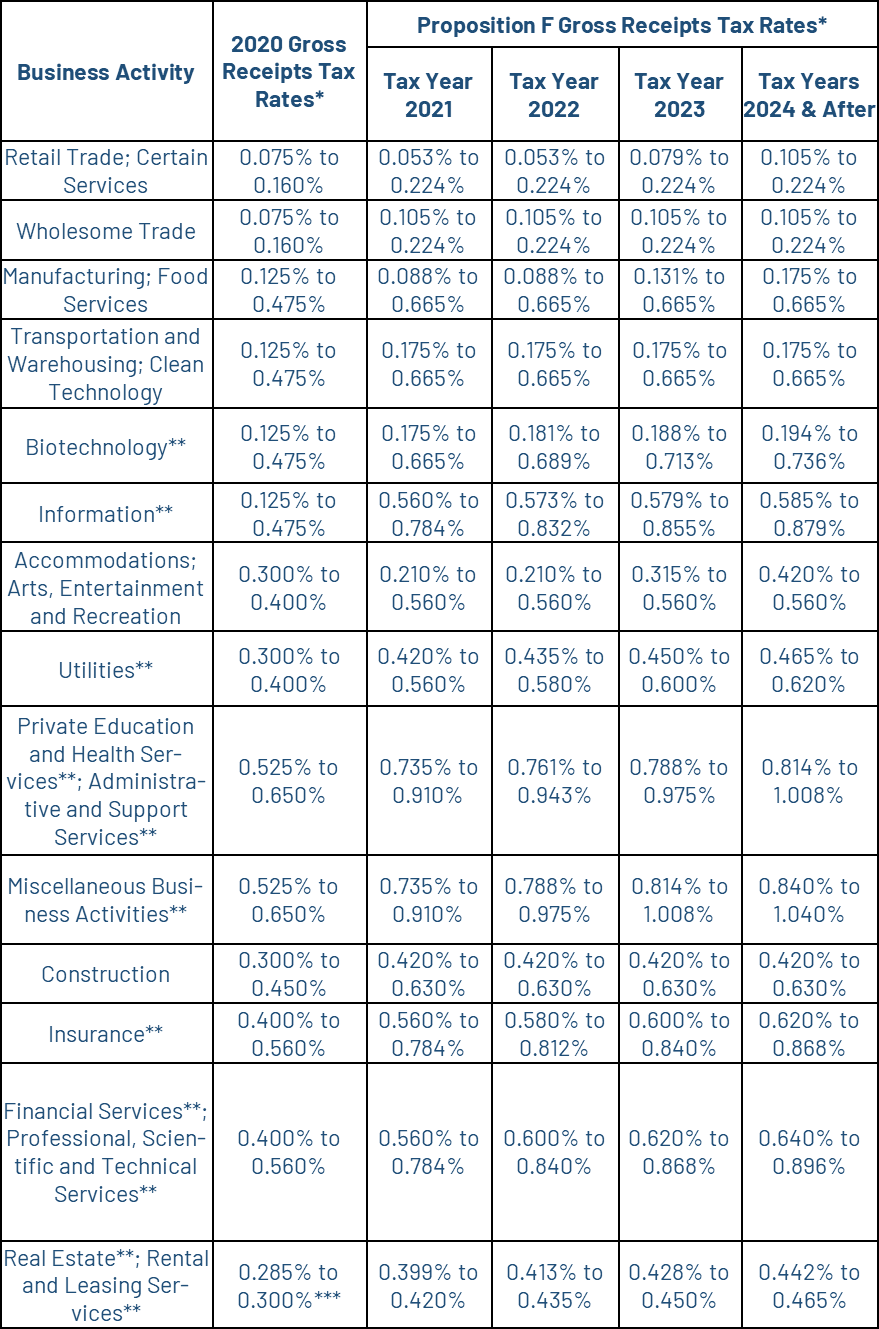

Gross Receipts Tax GR Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. San Francisco Business and Tax Regulations Code ARTICLE 12-A.

S F Teachers Are Resigning In Big Numbers The Payroll Fiasco Likely Isn T Helping

Click Register a company with the state on your own or Find account numbers and rate infothe company is.

. Employers must keep the same records for state income tax purposes as is required to be kept for federal income tax. For more information about San Francisco 2021 payroll tax withholding please call this phone number. Some businesses are also required to file and pay the Gross Receipts Tax and other annual taxes.

Click on a tax below to learn more and to file a return. Earned Income Tax Credit Notices. Search Withholding tax manager jobs in San Francisco CA with company ratings salaries.

In certain circumstances the business fails to collect or remit part or all of the withheld. If you take the components of the SF GRT 200M gross receipts 50 payroll in SF and the relevant GRT rate the current GRT and Payroll tax will come out to approximately. Your employer withholds a 62 Social Security tax and a.

With comprehensive information and tailored tools the portal helps you. State Disability Tax provides temporary funding for non-work related disabilities as well as paid family leave for those caring for an ill family member or bonding with their. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

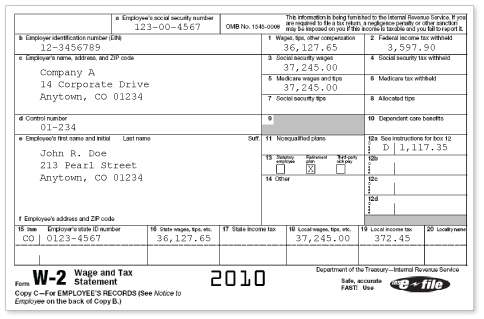

Proposition F fully repeals the Payroll Expense. See Form W-2 Requirements. The citys gross receipts tax which remains a stealth payroll tax for most companies will become especially confounding as remote work grows.

Unfortunately sometimes the payroll tax withholding process breaks down on a case by case level. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the. Proposition F fully repeals the Payroll Expense.

Select or make changes to your tax withholding status for federal and state taxes by completing the. A 14 tax on the San Francisco payroll expense of a person or combined group engaging in business within San Francisco as an administrative office in lieu of other taxes. Payroll Expense Tax.

Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Gusto partners with CorpNet to help you register in the statelearn more below. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24.

The San Francisco Business Portal is the ultimate resource for starting running and growing a business in our City. PAYROLL EXPENSE TAX ORDINANCE Sec. 56 open jobs for Withholding tax manager in San Francisco.

Tax rate for nonresidents who work in San Francisco. Proposition F was approved by San. Federal and State tax.

Apply to Caregiver Payroll Manager Regional Manager and more. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business.

Updated Irs Releases Guidance On Arpa Paid Leave Tax Credits Sequoia

San Francisco Payroll And Gross Receipts Tax Liability 101 Youtube

Taxes 2022 7 On Your Side United Way Answer Viewer Questions During Tax Chat Abc7 San Francisco

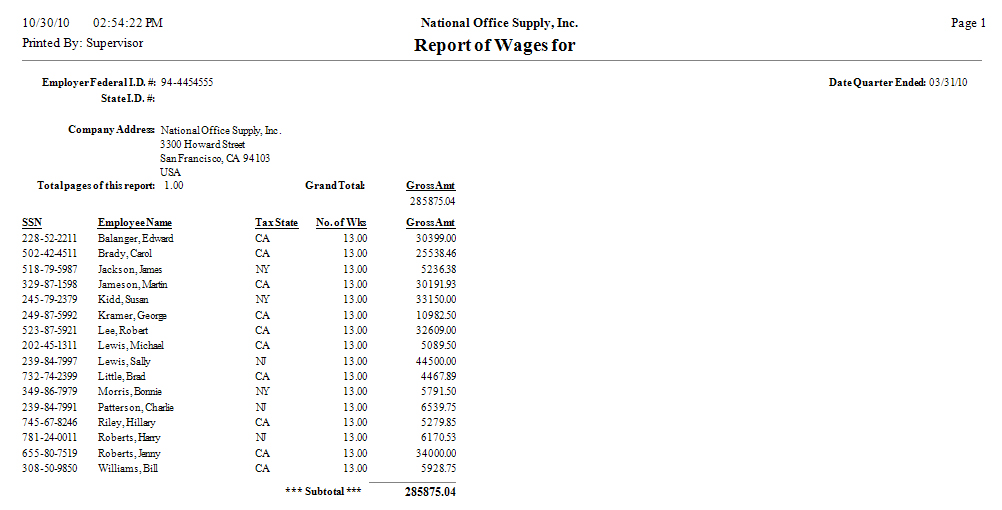

Accountmate Accountmate Business Management And Accounting Software Software That Fits

Payroll Deduction Authorization Template Google Docs Word Apple Pages Template Net

Trump Payroll Tax Holiday How It Affects Paychecks In 2021 Money

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

New Tax Law Take Home Pay Calculator For 75 000 Salary

Different Types Of Payroll Deductions Gusto

State Payroll Taxes Guide For 2020 Article

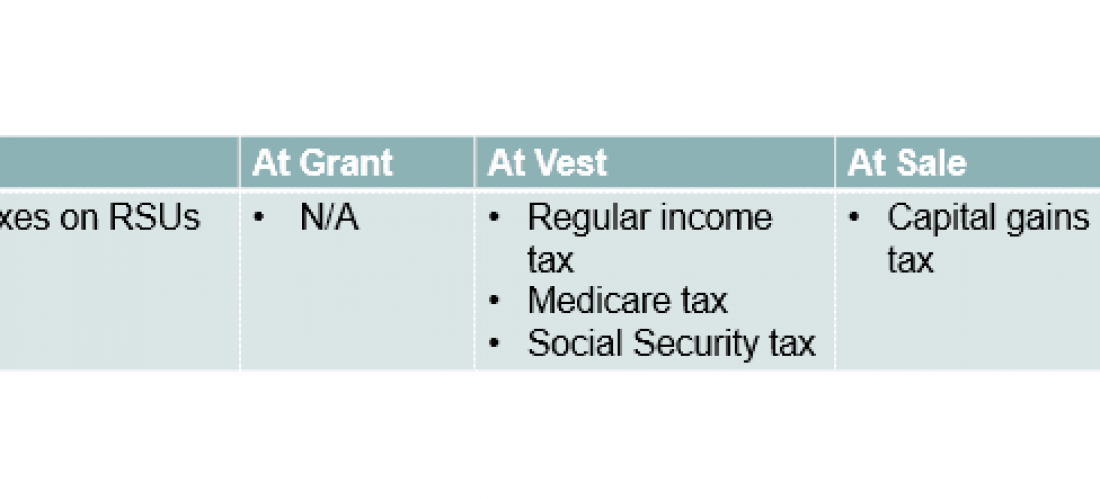

Equity Compensation 101 Rsus Restricted Stock Units

Gross Receipts Tax Gr Treasurer Tax Collector

Math You 5 4 Social Security Payroll Taxes Page 240

Are Tips Taxable Tax Advice For Gig Drivers Servers And More

2022 Federal State Payroll Tax Rates For Employers

Managing Employee Tax Withholdings

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management