prince william county real estate tax payments

Treasurer Tax Collector Offices near Woodbridge. To make matters worse for residential property owners property tax bills.

Prince william county real estate tax payments Thursday March 10 2022 Edit.

. If your real estate account does not show on the My Accounts screen it is because real estate account types generally do not automatically link when registering. For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed value of 300000 dollars is calculated as. The average homeowner will pay about 250 more in Real Estate taxes and fire levy taxes next year.

5 beds 3 baths 2608 sq. Correspondence and Tax Payments. When tax assessors estimate the value of your property they multiply that number by the tax rate of the county.

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living Police Basic Recruit School Graduates Today Share this post. Get Record Information From 2022 About Any County Property. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020.

Ad Searching Up-To-Date Property Records By County Just Got Easier. What is different for each county and state is the property tax rate. Please contact Taxpayer Services at 703-792-6710 M-F 8 AM 5 PM.

The county proposes a new 4 meals tax to be charged at restaurants. Prince William County Tax Administration Division PO Box 2467 Woodbridge VA 22195-2467. This estimation determines how much youll pay.

Press 1 to pay Personal Property Tax. In Prince William County Virginia the tax rate is 105 which is. Prince William County Government.

Payment by e-check is a free service. Have pen and paper at hand. Houses 9 days ago The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

Prince William County - Log in. Press 1 to pay Personal Property Tax. Dial 1-888-2PAY TAX 1-888-272-9829.

Have pen paper and tax bill ready before calling. Then they multiply that by the tax rate to get your property tax. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

The tax rate is expressed in dollars per one hundred dollars of assessed value. By mail to PO BOX 1600 Merrifield VA 22116. Press 1 for Personal Property Tax.

Ad Submit Your County of Prince William Payment Online with doxo. Please contact us at. The board voted unanimously to defer payments for the first half of annual real estate taxes originally due today July 15 -- until Oct.

You can pay a bill without logging in using this screen. Press 2 to pay Real Estate Tax. How property tax calculated in pwc.

Median Property Taxes Mortgage 3893. Hi the county assesses a land value and an improvements value to get a total value. A convenience fee is added to payments by credit or debit card.

The real estate tax is paid in two annual installments as shown on the. Prince William County Property Tax Payments Annual Prince William County Virginia. Report a Vehicle SoldMovedDisposed.

In Prince William County Virginia the tax rate is 105 which is substantially above the state average. You can read more at Propety Taxes in. Lookup and Pay other Property Tax bracket Rate Schedule Types of Taxes.

By phone at 1-888-272-9829 jurisdiction code 1036. In Prince William County Virginia the tax rate is 105 which is. The Prince William County Department of Finance reminds residents that personal property taxes are due on or before Monday Oct.

Who do I contact to get one in Virginia County Prince William. Real Estate Assessments 4379 Ridgewood Center Drive Suite 203 Prince William Virginia 22192-5308 Available M-F 8 am. However we can assist you in linking your real estate account.

Use My Location Manassas. Median Property Taxes No Mortgage 3767. Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county supervisors took Tuesday.

Dial 1-888-2PAY TAX 1-888-272-9829. Make checks payable to Prince William County. Prince William County Virginia Home.

I havent received my property tax bill yet. Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone. All you need is your tax account number and your checkbook or credit card.

Have pen and paper at hand. By creating an account you will have access to balance and account information notifications etc. Prince William County Real Estate Assessor 4379 Ridgewood Center Drive Suite 203 Prince William VA 22192 Prince William County Assessor Phone Number 703 792-6780.

Prince William County - Home Page. Report a New Vehicle. What is different for each county and state is the property tax rate.

Follow These Steps to Pay by Telephone. -- Select Tax Type -- Bank Franchise Business License Business. Prince William County Property Tax Payments Annual Prince William County Virginia.

The real estate tax is paid in two annual installments as shown on the tax calendar. Enter the Account Number listed on the billing. Newer Post Older Post.

300000 100 x 12075 362250. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020. Enter jurisdiction code 1036.

Then they get the assessed value by multiplying the percent of total value assesed currently 100. The county assessed home. Click here to register for an account or here to login if you already have an account.

There are several convenient ways property owners may make payments. When prompted enter Jurisdiction Code 1036 for Prince William County. 3323 Prince William Dr Fairfax VA 22031 860000 MLS VAFX2067646 Imagine coming home to a peaceful haven tucked amid towering mature trees that m.

Prince William County Considers Rebranding Post Pandemic Headlines Insidenova Com

Recently Sold Homes In Prince William County Va 30 638 Transactions Zillow

Join Renew Realtor Association Of Prince William

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Recently Sold Homes In Prince William County Va 30 638 Transactions Zillow

National Park Service Prince William Forest Park Sign Virginia Travel National Park Service Forest Park

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Market Statistics Realtor Association Of Prince William

Prince William County Real Estate Prince William County Va Homes For Sale Zillow

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Data Center Opportunity Zone Overlay District Comprehensive Review

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

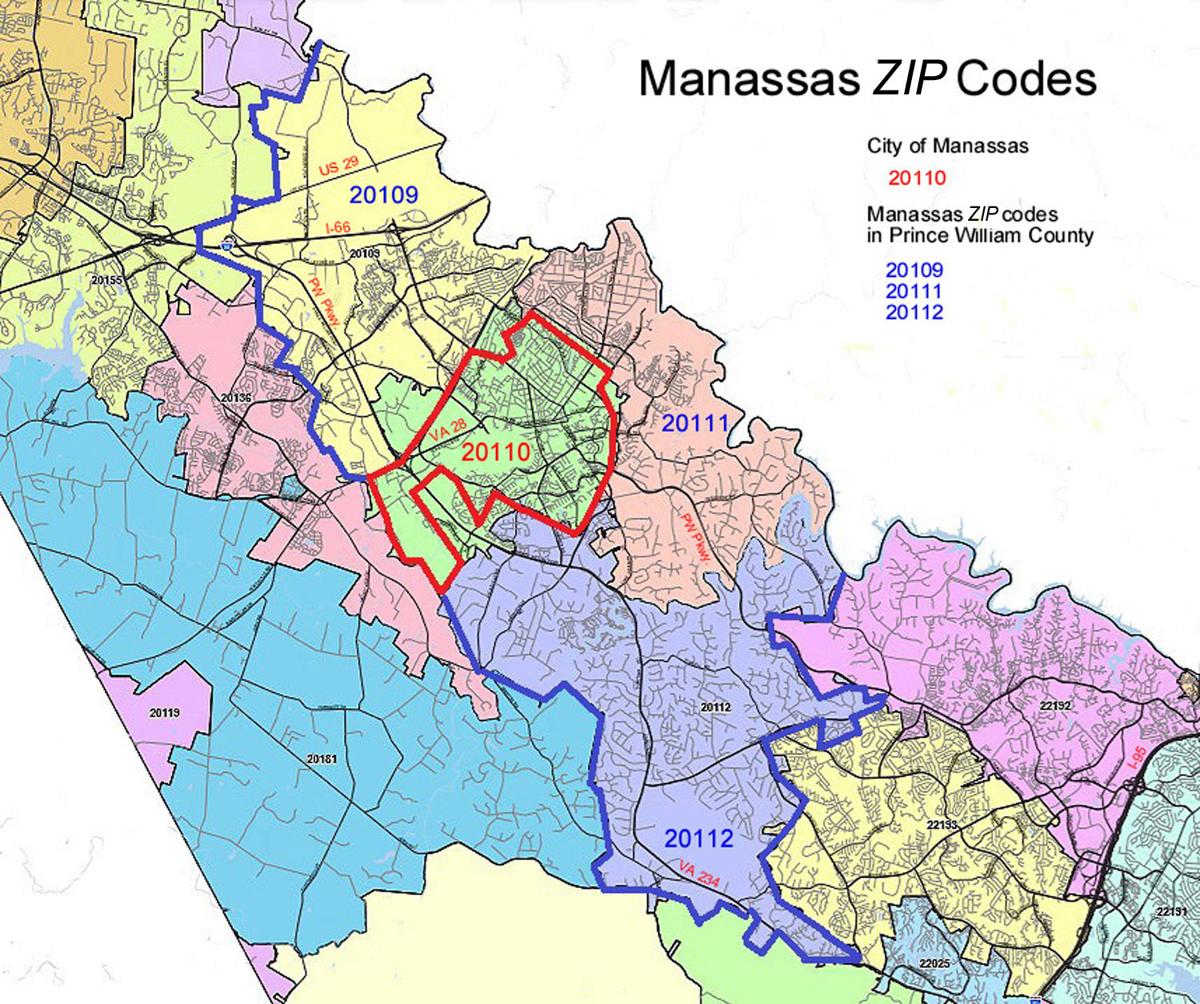

Guest Column When Is Manassas Not Manassas Opinion Princewilliamtimes Com

Animal Advocates Call For A New Prince William Animal Shelter Headlines Insidenova Com

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Prince William County Data Center Site Sells For 74 5 Million Dcd